Bailout

The term bail-out (English bail out ) or rescue called in economics the process of debt assumption and repayment or assumption of liability by third parties, in particular by the state or state institutions, in the case of an economic, financial or business crisis.

Types of bail- outs

Can be distinguished bail- outs at different levels:

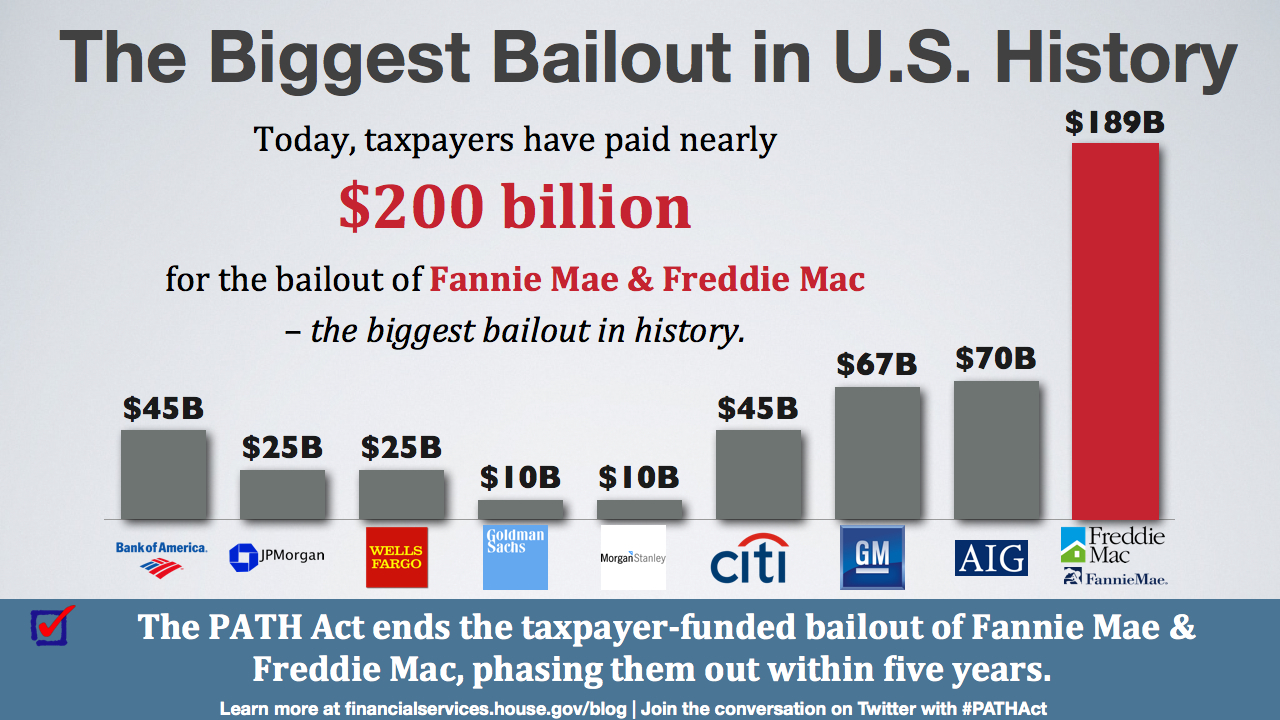

- Private sector bail- outs, for example between banks among themselves ( deposit insurance fund ) or state and banks ( eg in the context of the financial crisis from 2007 through state liability fund ) or between state and privately organized companies

- Subnational bailouts, for example in financial federal states between authorities and downstream of the upper state level, between state and state-owned enterprises or para-fiscal ( as the famous bail-out of the United States for New York City in December 1975)

- International bail- outs, for example, between countries or international bodies and states (for example, IMF and Argentina between 1998 and 2002 )

- Multilateral bail- outs, for example, between countries or international bodies and states (for example, European Union and Greece in 2010)

Government bail out

Government bailouts are often justified by the defense of a system-endangering damage, bring him as to the insolvency of a significant ( " Too Big to Fail" ) reputable company with them. This is especially true for the banking sector ( Financial Stability Board ), but also for large industrial companies. The government bailout is to eliminate the crisis in order to prevent adverse effects on the entire economy. A government bail-out, according to this view rather than repeal the laws of the market, but a trade-off question and a time-limited intervention.

Be viewed critically bail- outs because of the risk of moral hazard, ie the incentive to take excessive risks and thus contribute to a vulnerability.

It is discussed in several countries to claim the cost of the bail- outs of financial crises through a bank levy on the financial sector.

No-bail -out as the essential basis of the German euro - accession

Under Article 125 TFEU, neither the European Union nor its Member States shall be liable for liabilities of other member countries (non - assistance clause). Germany prevailed that this rule and some others were taken into account in the 1992 Maastricht Treaty, to ensure that the European currency would be as stable as the D-Mark.

The Federal Constitutional Court approved the agreement in 1993 and wrote it for non- assistance clause: This conception of the monetary union as a community of stability is the basis and purpose of the German consent law. .. If the monetary union, the existing on entry into the third stage of stability is not continuous in the sense of the agreed order stabilization can continue to develop, they would leave the contractual conception. The court announced at that time, to intervene in such a case.

Then hoping some euro - opponents to Joachim Starbatty, who had in 2010 again (as in 1998 ) sued in vain before the Federal Constitutional Court - an urgent application was rejected. From shortly after made 123 -billion commitment from the federal government they knew (and the court) at the time of rejection anything yet.

Unlike bail-in

The antonym Bail means the participation of the creditor side ( credit institutions, investment funds, suppliers, etc. ) to the cost of a crisis management with borrowers in a corporate crisis.