Diversification (finance)

The term diversification or diversification referred to in economics an expansion of the range and refers to new products for new markets. The diversification contrasts with the mono-structure. A distinction is made between a horizontal, vertical and lateral diversification.

The term is common in particular in relation to the product policy of a company and for investments.

- 2.1 instruments

- 2.2 The risk diversification depending on the correlation coefficient

- 2.3 Risk

Product diversification

A product diversification occurs when an entity introduces a new product in a new market. The opposite is the market penetration. Diversification is the riskiest part of the product - market matrix by Ansoff. One possible measure to measure the diversification is the Berry index.

Diversification can occur in three forms:

- Internal: The company grows its own and develops the product itself

- Acquisition: Another company will be added together bought the desired products.

- Cooperation: New products are developed with a partner. Cooperation may be the intense, loose joint ventures to strategic alliances and networks.

There are three directions in which diversification can spread: Horizontal, vertical and laterally.

Horizontal diversification

This refers to the expansion of the existing product range on the same economic level product lines ( industry ). It turns either to new customers or serve the same customer base, but solves new problems these customers. Consists an objective connection between the new and old product lines.

For example, a car manufacturer takes vans and campers to its list of products.

Vertical diversification

The vertical diversification is based on the value chain and describes the extension of the production program of products from upstream or downstream economic levels (also called Rückwärts-/Vorwärts-Integration ). The so-called vertical integration is extended so.

As examples of vertical diversification of upstream economic stages would be a restaurant to call, the agriculture for the production of cheap meat and vegetables engages and produces a car manufacturer, the tire or car batteries. From vertical diversification at downstream stages one speaks, for example, at a production company, opens its own stores.

One difference for vertical integration is that these new products are intended for the market, not just for their own use of the company.

Lateral or diagonal diversification

The expansion of the production program for products that are completely new to the company and have no technical or economic context of the previous products is referred to as a lateral diversification. Among them, for example, falls a car manufacturer that produces refrigerators.

The lateral Diversification means a distribution of risk for the manufacturer. The business risk is passed to both the automotive and the refrigerator production. The experience of the manager can be utilized particularly well here.

For sub-division of the lateral diversification is often recurs to the concentric and conglomerate diversification. For this is the third distinguishing feature next to the product and the market still on a third criterion, the resource resorted to.

Diversification in the money and capital market investments

From diversification is spoken in investment in financial products, if current savings or one-time asset amounts are not completely flow into a single system, but on different types of investments (eg, types of securities such as stocks, bonds, mutual funds, etc.) as well as on various financial services or securities issuers - distributed - possibly located in different countries.

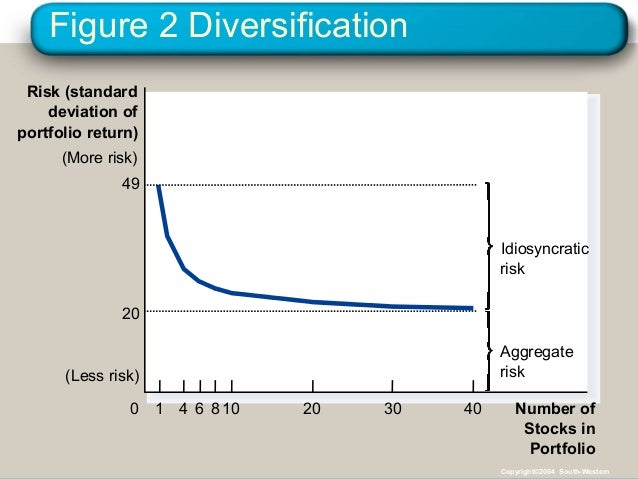

Background of this popular investment strategy is a risk diversification, that is, the avoidance of a possible total loss by simultaneously investing of partial amounts in alternative, different risky forms of investment, so that the total wealth is scattered in various financial instruments. The desired effect of risk reduction is accomplished by two or more securities with each other have a low correlation, are combined in a portfolio. The asset structure thus obtained has an overall lower risk than the respective individual papers. Is a prerequisite for this effect, that the underlying securities are not correlated 100 % positive; they have each a correlation coefficient which is smaller than 1.

For example, a fixed investment amount is not invested exclusively in a manufacturer of umbrellas shares but also proportionately into shares of producers of umbrellas - what the weather will also, it is not everything on a single card, but in a sense familiar to several irons in the fire. Each company on its own may produce a good return and have their own risks, but together in a portfolio, the yield is produced at significantly lower risk.

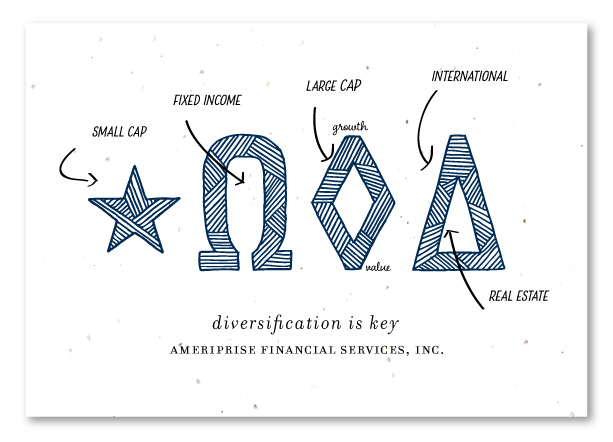

Instruments

Depending on the investment objectives (maturity, yield and risk preferences ) are a variety of direct investments in stocks, bonds, real estate, options and futures or indirect investments in securities investment funds to choose from. There are even significant differences within the individual asset classes. For example, annuities can be secure instruments such as government bonds and mortgage bonds, but also riskier forms such as corporate bonds, foreign bonds (for example, in U.S. dollars or, for example, Ukrainian currency ). The investment risk here is quite different.

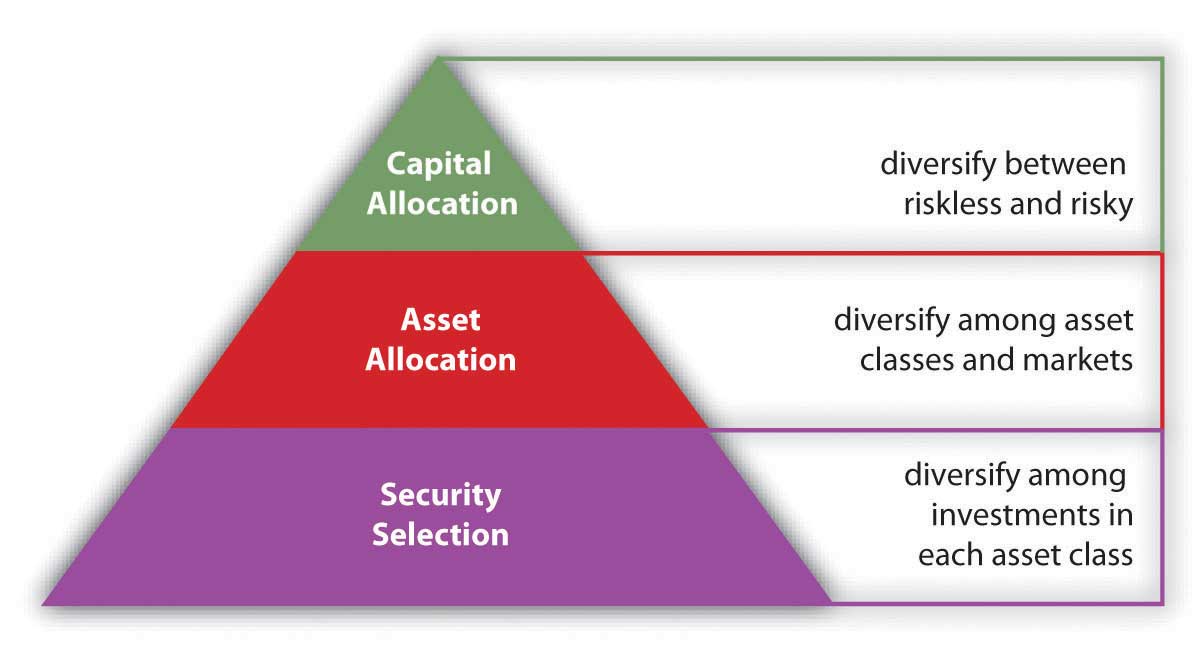

The investment objectives can be realized in principle in two ways:

Risk diversification depending on the correlation coefficient

Risk and return are statistically mutually interdependent. This relationship is often called risk / reward ratio. For simplicity, it can be termed as equity / bond ratio in a depot. As risk is the variance or the standard deviation of the securities or of the portfolio. A minimal variance portfolio can be derived depending on the correlation coefficient. If all of the securities in the portfolio are correlated to 100 percent, weighted to the securities with the smaller risk stronger.

Risk

A common measure of the price risk of a listed security is its volatility expressed as standard deviation ( second moment). Since the standard deviation is based on the assumption of normal distribution, are also risk measures "higher moment " to bear. The skewness ( engl. skewness ) measures the deviation from the mean of the normal distribution (3rd moment). A distinction between right and left skewness. In addition, the kurtosis exists (4th moment). It measures the values at the respective end of the normal distribution curve. With the advent of hedge fund risk measures gain higher moments in importance as " hedge funds " usually have return distributions that are not measurable with traditional risk measures.

But is most common risk measure of volatility. Is based on this and the so-called "short - fall" risk which indicates the profit or loss probability. In strong bull markets or market anomalies, these variables are often missed, that is, there is no gain. It can occur even substantial losses, since this risk measure falls short.

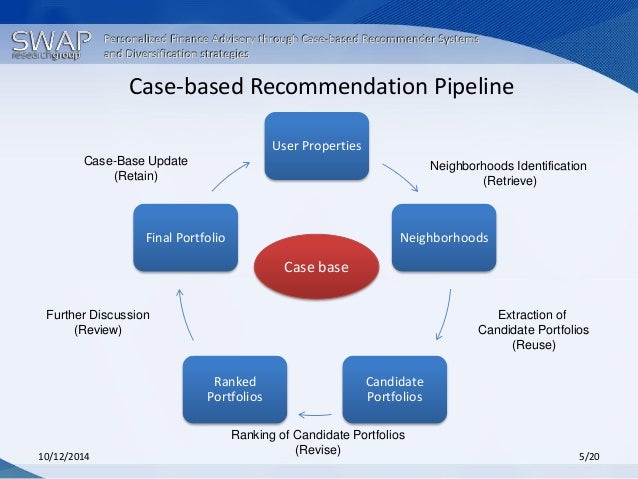

Task of an experienced investment advisor is to offer the customer in accordance with its objective and / or subjective risk assessment, the right mix of different asset classes and thus the long term to achieve adequate performance of the invested capital.