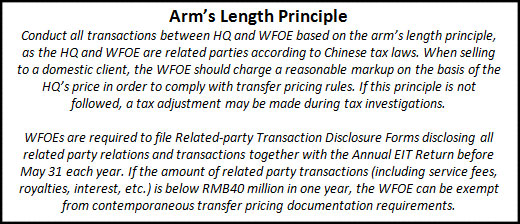

Arm's length principle

The arm's length principle (English arm's length principle, ALP) relates in particular to transfer prices for deliveries of goods, rental and lease interest or financial transactions ( inter alia " cash pooling " ) under the exchange of services. Within companies, affiliates or shareholders with their companies

The term comes from " arm's length" and means that between two people a certain distance is available ( to keep someone at arm's length: someone away, remain independent). In the Anglo -Saxon legal system, but now also the world, this is an accepted principle for an exchange of services " as between unrelated parties." In the U.S., based on this principle rules particularly extensive and in 26 CFR 1.482 are regulated ..

History and first definition

The Tax Committee of the OECD has spread for the first time in 1979 in Article 9 of the " Model Tax Convention " in the context of an international recommendation to the arm's length principle. After that is spoken by arm's length principle, if the relationship between affiliates or between shareholders and their companies transfer prices are set for services such as this would occur between unrelated, independent enterprises.

Tax Aspects

Action related undertakings according to this principle, this automatically leads to a distorted presentation of the profit and loss situation of the companies involved. The company, which pays a higher transfer price than it would have paid on the market outside the Group for similar performance, has a lower profit (or higher loss ), while the recipient undertaking a higher profit (or lower loss ) generated as at market prices. Consequence of this is that in the disadvantaged business incurred lower income taxes than at market prices. That may not matter if all the relevant Group companies in the same country ( formal violation ). However, if this principle across borders injured in multinational corporations and disadvantaged a group company in a high tax country, then there is also a material violation. This flow to the high-tax country less income tax than to compliance with the principle. Then, speaking from the federal tax authorities of a shift profits.

Economic aspects

Of these (minority) shareholders of the companies involved are affected because they receive less or more dividend than the basis of market prices. However, you can only exert indirect influence ( voting rights at the Annual General Meeting ), since the establishment of transfer prices of corporate management responsible.

Transfer prices

Transfer prices can be divided into internal, inter-company and transfer pricing. The latter are charges for the exchange of services between legally independent companies within a corporation. The determination of prices has a direct effect as an expense when paying company and the income / proceeds at monopolizing companies.

Arm's length principle in Germany

The tax orientation principle can be derived in Germany from § 1 para 1 Foreign Tax Act. It requires tax corrections if company law related " control subjects" (ie, taxable companies or individuals ) to enter into transactions with each other, which had not been agreed with third parties. In the consolidated accounts, the DC gains achieved through intra-group sales, provided that they do not result from normal market conditions, eliminated ( § 304 Section 1 of the Commercial Code). Both schemes turn, can be seen in connection with the tax provisions of § 8 para 3 CITA, which deals with the forbidden hidden profit distribution. Since tax and commercial provisions pursue identical goals in arm's length principle, falling trade and tax accounts from harmonious.