Balance sheet

The balance (of Italian bilancia " (bar ) scale ", from the Latin BILANX " double scale " ) is a statement of the origin and use of the capital of a business entity, such as a company or a corporation. It is a brief comparison of wealth (assets) and capital (liabilities) in the form of accounts. Another approach, the dynamics of the resources in the foreground; she uses the terms of funds for the assets side and capital resources for the debit side.

History

The Franciscan monk and mathematician Luca Pacioli described in 1494 in his book Summa de Arithmetica, Geometria, Proportioni et Proportionality the first complete presentation of the " Venetian Method" ( duplicate accounts), as practiced probably driving in long-distance trade Italian city-states. Venice was formed at that time the center of a global economy that stretched from Poland to Western Europe and the Mediterranean to the Black Sea. The basic principle of double-entry bookkeeping, which also applies to the presentation of the balance sheet is, to this day remained unchanged and is used globally.

General

The balance sheet is a part of the year, an interim financial or other date analysis of a company. They, together with the profit and loss account for the economic success of a company in a past consideration represents a balance sheet is prepared on a particular date (closing date ), while the profit and loss account is created for a period of time. Computing Technically, the balance determined from the books and records, summarized and systematically structured balance sheet dar. By comparing the final stocks of the various asset and liability accounts - especially the capital account - at different times, the economic development of a company represented across time and through inspection of the accounting records be traced. For this reason, one speaks in accounting from the balance sheet comparison.

The balance sheet provides the following functions:

Colloquially referred to also balance the overall financial statements of a company. The assessment of a company due to its financial statements are called accordingly, financial statement analysis. It is an essential component of fundamental analysis.

The information function is available for financial statements in accordance with IFRS (International Financial Reporting Standards ) in the foreground. The activities of internationalized capital markets need uniform rules, according to which the company's success is measured. Consolidated financial statements according to HGB and IFRS but does not have from the distributable profit. This continues to be detected in company with headquarters in Germany exclusively by the Commercial Code.

Balance types

Structure of the balance sheet

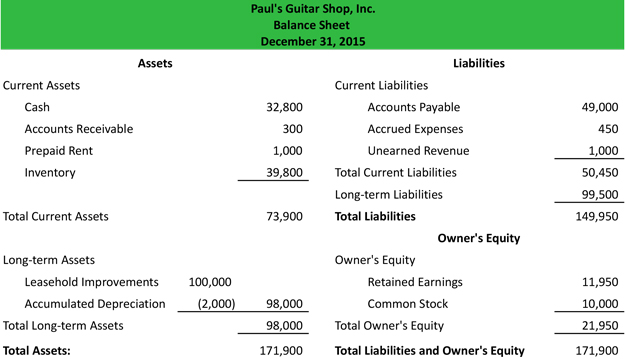

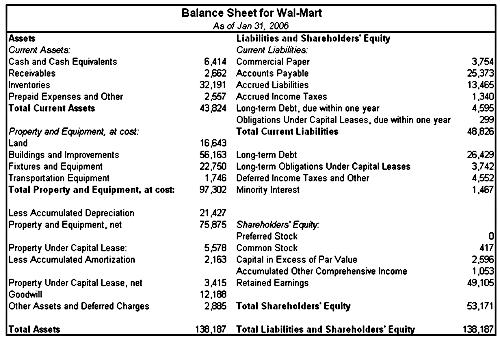

The balance sheet is shown divided into two areas:

- The asset side, the use of funds is: show assets, which claims the company has acquired the means available economic means. These claims may be funds ( eg cash, bank accounts ), means of production (eg, real estate, machinery ), raw materials, intermediate products and similar material goods. In addition, a number of intangible assets must be listed - these are not always directly financially measurable ( see below: Current problems in accounting ); However, there is often a good indication of an estimate. Roughly the asset side represents the asset structure of the company.

- The liabilities side, the source of funds is: show liabilities as funds are financed with which the company conducts its business (Figure financing structure). This is in particular a distinction between debt and equity. Equity refers to the means which are not subject to reimbursement by third parties, that is, in particular, the introduced strain and capital as well as from the company itself generated reserves and retained profits. The debt includes agents that are ( time-limited ) of provided to third parties, such as mortgages, bonds, loans and supplier credits.

The assets are usually shown on the left side of the balance sheet, the liabilities on the right side. To the same total of all items must equal on both sides, the balance sheet total.

Germany: Balance sheet classification according to § 266 HGB

Suppliers are classified as a separate reporting of fixed and current assets, equity, liabilities and deferred income (§ 247 ). In accordance with § 266 HGB is according to the German Commercial Code, as amended v. December 20, 2012 (Federal Law Gazette I p 2751 ) compiled balance of a corporation ideally constructed as follows:

Suffered by the company as high a loss that equity is calculated is negative, the case of corporations the " negative amount " is ( math. correct: absolute value of the negative equity ) as " not covered by equity shortfall" reported on the asset side § 268 In commercial partnerships this corresponds to the " Not by capital contributions covered loss component" of the general partner and the limited partners in accordance with § 264c.

Deviations from this accounting scheme arise, for example due to the legal form (see § 264c HGB), size ( see, eg, § 274a ) or industry. Also, individual significant transactions or items may require pursuant to § 265 Outline principles adjustments. Exist for credit and financial services institutions, insurance companies and pension funds separate balance sheet classification schemes according to separate regulations ( Regulation on the accounting of the credit institutions and financial services institutions and regulation on the accounting of insurance companies ).

Switzerland: balance sheet by Obligations

Under Swiss law, the commercial accounting rules in the Code of Obligations ( OR) are regulated. For the balance of Article 959a OR requires the following minimum classification:

* The amount from directly or indirectly involved and organs as well as to companies in which a direct or indirect ownership interest exists is to call separately in the balance sheet or in the notes.

In practice, the assets under the liquidity principle, the liabilities are classified according to the maturity principle. That is, the more quickly an asset can be made liquid or a liability is due, the higher up it is placed. The comparison of such minor assets and liabilities are an indication of the liquidity of the company.

International: balance sheet pursuant to IFRS

A prepared in accordance with International Financial Reporting Standards ( IFRS) balance differs in structure of a balance sheet in accordance with HGB. The structure of the IFRS balance sheet is required under IAS 1, paragraphs 51-77 ( "Balance Sheet "), whereby IAS 1.51 while the company admits two basic ways to balance sheet classification:

- A breakdown by maturity ( on the asset side: current assets and non- current assets and correspondingly on the liabilities side: current liabilities and non -current liabilities ) as the norm and

- A breakdown of assets and liabilities in each of their liquidity as an exceptional case.

A clear definition whether this structure has to be done in ascending or descending order, it does not exist. However, the Accounting Interpretations Committee prefers (RIC ) of the German Accounting Standards Committee (GASC ) in RIC 1 ( Accounting Interpretation No. 1, " balance sheet by maturity in accordance with IAS 1 Presentation of Financial Statements" ) as guidance for the accounting German companies by IFRS apparently the order of the long term - short term ( see Annex to AIC 1: Example of a balance sheet classification scheme).

Income recognition

In tax law, the Company's success is balance sheet comparison determined (§ 4 ITA). In the balance sheet, capital (equity debt) corresponds to the business assets. However, private deposits of the entrepreneur do not contribute to success, as well as private withdrawals do not reduce the success.

The success / profit is thus

- Equity at the end of a fiscal year,

- Net equity at the beginning of a fiscal year,

- Less customer deposits during the financial year,

- Augmented by private withdrawals.

However, the success does not have to always be positive, because a loss is referred to as " a company's success ."

Generally accepted accounting principles and accounting

Basis in the preparation of a balance sheet is the orderly accounting. The balance is to draw a fair, accurate and comprehensible picture of the company to date. This is called the principle of economic reality and principle of balance clarity. In addition, the principle of prudence, inaccurate quantifiable stocks should be assessed rather pessimistic and possible risks are taken into account, where appropriate, applies. Governed these standards are the principles of proper accounting (GAAP ).

Who shall draw up a balance sheet, is regulated by the Commercial Code. There is also the statutory construction to find.

In the balance of all the facts must be included that are known at the time the balance sheet and relevant to the period between two balance sheet dates. Therefore, it is not enough to receive a present at the relevant date account balance in the balance sheet. In addition to related in the period before the balance sheet date but not yet paid will be assessed. It should also be noted that payments have already been made for services that are not occupied until the following year - for example, a prepayment for raw material supplies.

One difficulty in the preparation of balance is, therefore, that at a time rarely all facts to be considered are already quantifiable. Thus, for example, known that a company will get a phone bill for the month of December. Since the use of this power was already in December, the legitimate demand of the provider must be included in the balance sheet. The corresponding statement is, however, possibly until the end of January of the following year before. Thus, it is practically impossible to balance both precise and to create a timely manner. According to perish in large companies usually two to four months until the announcement of the annual balance sheet. On the other hand, a timely balance is expected especially for listed companies, so that - and this tendency is exacerbated in recent years increasingly - often at the expense of accuracy as quickly as possible balance is created, in which many values could only be estimated.

Furthermore, calls for the full breakdown of the financial picture an actual inventory at the time of the balance sheet. For existing products, this is done mostly in the form of an inventory where the possible differences between the detected changes in inventories and stocks actually held can be held.

Finally, the evaluation of the assets of a company takes place. Realistic values will need to be determined for those in the Production used resources ( eg machines ) and for the long -term financial assets (eg, real estate and corporate investments ). This can be done by depreciation, so that the value of a company car on the planned use of (for example) eight years is reduced evenly in each year by one-eighth of the purchase price ( straight-line ). Another approach is to determine the theoretical selling price, which is mounted especially for investments in publicly traded values ( shares of other companies ). Here, for example, the number of shares owned by the company may be valued at the exchange rate on the last trading day before the balance sheet date.

The accounting policy refers to the basic orientation of the reporting entities in the use of identification, classification and explanation of voting rights (formal accounting policy ) as well as in the use of valuation options, discretions and grooming transactions (tangible accounting policy ).

The alignment of the accounting policy of a company is not negligible. Thus, this may change the balance by, for example, different evaluation approaches and various possible states of affairs.

To protect the creditors of a company applies to the valuation of assets, the so-called precautionary principle, which finds its concrete application in the following valuation principles:

- Historical cost convention

- Lower of

- Maximum principle

- Imparitätsprinzip

Accounting theories

- Traditional accounting theory The static balance theories busting statics

- Continuation statics

- Capital and asset maintenance

- Economic profit

- Future balance

- Synthetic balance sheet

- Analytical balance function

- Forecast balance

Current problems in accounting

At least since the beginning of the information age shows that the value of intangible assets for the valuation of a company can gain a growing importance. Thus, exceptional knowledge ( corporate knowledge, see knowledge management, intellectual capital ) provide a first in the future actionable financial success in market advantage. Likewise successfully introduced brands are considered valuable property, but they help in the creation of customer trust and customer loyalty ( cf. brand loyalty ).

The difficulty with the presentation of a realistic economic representation, however, is quite relevant these intangibles to award a reasonable value, say for example to determine the brand value. Since the future arising under these goods return is not realistic to predict likely a company- wide structure for this representation can wait a few more years away.

Especially for service companies, the business success - and therefore the value of the company - may depend on assets, the balance sheet did not let yet grasp, especially the employees with their skills and knowledge. The staff go on base with the concluded employment contracts of their activities for the benefit of the company. You - not machines - generate services and thus sales to customers. You decide by the quality of their performance on the success or failure of a company. One example is the so-called " investment banks " whose business success depends to a substantial degree of customer contacts and knowledge of the employees. Due to an existing foundation of trust between customer and an individual employee, the company receives orders - or not.

The business administration, it is not yet succeeded in sufficient dimensions to formulate generally accepted accounting policies for the economic production factor labor with regard to the activation of human labor.

Internally generated intangible assets ( cf. § 268 para 8 HGB ), such as software or patents, can be applied only under strict conditions in the balance sheet (similar to those set out in IAS 38 criteria ) to German and Austrian Commercial Code. In a corresponding amount, however, is a separate reserve in equity accounted for, so that a distribution restriction in the amount of the intangible values less burdensome on deferred taxes attacks. Created for the sale of intangible assets are recognized as current assets and are valued at production cost.

When acquiring companies (all assets and liabilities, executory contracts ) without taking over the right jacket ( otherwise it is simply an acquisition of shares, which is accounted for at cost ) arises when a difference (goodwill ), considered the limited usable asset. From this follow depreciation. In the IFRS an impairment only in case of losses is made at the balance sheet date. In times of exaggeration of the New Economy led acquisitions of businesses in part to unjustified high purchase prices, which expressed itself in a high goodwill. In business combinations, the future success of the purchase price determination not the substance, ie approximately in the balance sheet expressed values are used as basis. In contrast to the expectations of the acquisition date residual income cause the goodwill must be written off. It was the largest losses, the companies have ever reported. Most this was seen at AOL, which had to write off the goodwill that arose on the acquisition of Time Warner. In international comparison to American corporations recorded significantly higher intangible assets in European companies. In part this can be attributed to the strict SEC oversight. Financial statements ( consisting of balance sheet, profit and loss account and notes ) of corporations have published or filed with the Register Court and - at a certain value frontiers - be a Laagebericht (§ 289 ) examined by an auditor. Is regard to the functioning of the capital markets and the legal profession, the auditor has been modified several times. Member States of the European Union and the European Parliament have tentatively agreed on the text of the amended Directive and the new Regulation on statutory audits. COREPER (Committee of Permanent Representatives) approved the compromise versions on 18 December 2013.

Bank's balance sheet

The bank's balance sheet provides information about the liquidity situation and the risk situation of a credit institution. The classification is done according to § 340 HGB i.V.m. Form 1 RechKredV on the asset side of decreasing liquidity, that is, it starts with cash. We distinguish static and dynamic liquidity. On the liabilities side, the debt stands in front of the equity; it is divided in order of increasing maturity.

The asset side of differentiated between receivables and securities; other hand, does not distinguish between fixed and current assets. Tangible assets can be found under Other assets again. The liabilities side differs liabilities and debt securities.

The informational value of the bank's balance sheet in cash flow terms is limited. There is a date-based account. In addition, requires the objectification, for example, in terms of maturity or the recognition and measurement rules, to differentiate between different levels of liquidity.

The bank's balance sheet into account credit risks, but no interest rate and exchange rate risks. Subordinated loans are carved out of the balance sheet or in the appendix.

National Accounts

The European System of National Accounts (ESA ) provides in national accounts before balance sheets, in which the assets ( non-financial assets and receivables) with the liabilities ( liabilities) to net assets are netted.

Financial balance sheets balance the gross financial assets, receivables, with the liabilities to net financial assets.