Book value

The book value (English: book value) is a value approach in the valuation of companies or individual items.

Commercial and tax law called the book value of the cost of a single economic good minus the ( commercial law ) Depreciation or the ( tax ) depreciation. This approach is defined legally and therefore differs from the " true " value (referred to in tax law as part of value or fair market value ) of an asset in all rule. In Umwandlungssteuergesetz is the book value of the lowest possible value approach, along with fair market value and intermediate values will be accepted.

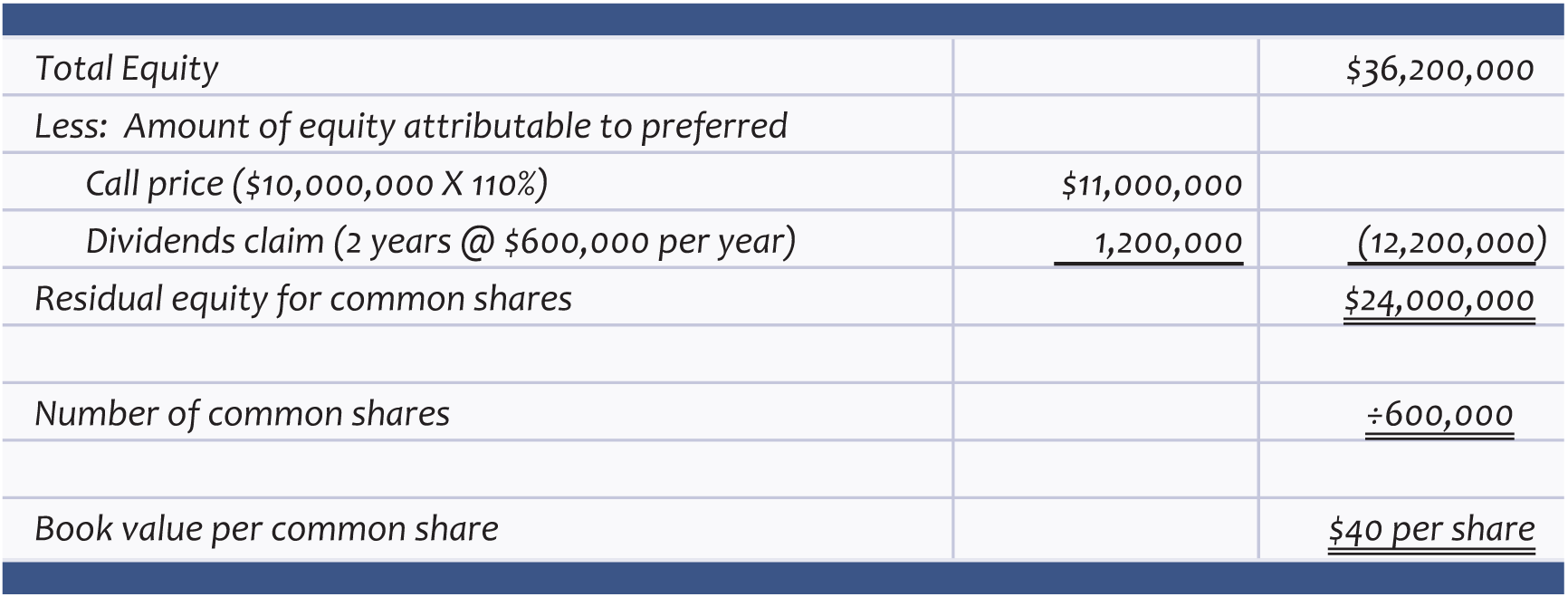

Looking at a whole company, the book value is the value attributable to the company's equity holders. For this is done, the reduction of all assets to the liabilities and special items, in the Group and non-Group to share. In an alternative method, the intangible assets are deducted in addition.

Application in business valuation

The company code book value / share is the height of the amounts attributable to shareholders equity per share.

The book value only takes into account the balance-sheet entry value of assets, but not possible hidden reserves or hidden charges. Also, the accounting system used (eg HGB, US - GAAP or IFRS) leads to different accounting measures, so that the reported book values - sometimes considerably - may differ.

A more meaningful for business valuation figure that is based on market value or replacement value of the assets, the net asset value. But this is not defined by accounting systems.