Contestable market

Under contestability ( contestability English ) refers to the ability of market entry by potential competitors in microeconomics. If a market entry easily possible (ie are few or no market barriers before ), so we speak of a contestable market. Can other companies due to high market barriers even at high achievable gains do not enter the market, so it is a non- contestable market.

The contestability of a market is determined by the existing market market barriers, access to sales, procurement markets and appropriate technologies, as well as the pricing behavior of the previous provider on the market (in the case of a monopoly or oligopoly ).

Contestability can also be regarded as a social dilemma: If we look at two companies that are each faced with the choice whether to enter the market or not, can be a sole market entry lead to high profits. A non-occurrence, however, even leads to no cost, but to no gains. More problematic is the situation when both players decide to enter the market. For then, none of the companies expect a monopoly profit, instead of sunk costs.

Theory of contestable markets

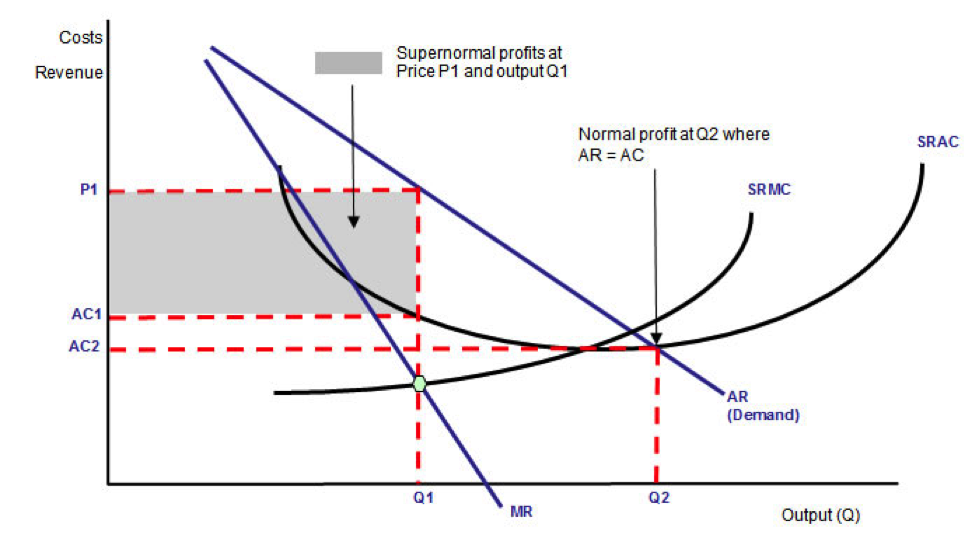

The theory of contestable ( vulnerable ) markets states that under the assumption of perfect substitution of the market holder at the entrance, no barriers to entry and no sunk costs affects (eg cost of informational advertising), alone the threat of market entry to the market owner disciplining ( hit- and-run strategy possible). Problematic are the assumptions to see that there are no barriers to entry, which is hardly the case in reality, and that the replacement of the market owner is perfect, which implies unlimited capacities and that the prices are more rigid than the amounts, which in reality is rather the reverse.

Example

A monopolist produces a homogeneous good. He is faced with the demand (p = price). His fixed costs (F ) amount. The monopolist simplicity has no variable costs. The monopolist wants to maximize its profit ():. A maximum occurs when the first derivative of the gain is zero and the second is less than zero.

The market is vulnerable because it is rewarding for another company to enter the market to undercut the monopolist and earn positive profits. Thus, the market is not open to attack, the monopolist sets the price at which it makes zero profits.

.

The theory of contestable markets served as a competitive political doctrine of the Thatcher government. It postulates that the free market access sufficient to allow monopolists were to offer to the average cost rather than monopoly prices and it would lead to the optimal allocation of resources. Therefore satisfy the contestability of the monopoly.