Equation of exchange

The quantity equation (also transaction equation, transport equation or exchange equation) provides evidence on the relationship between money and goods transactions within an economy, and is underpinned by the quantity theory of money. In addition to various forms of the quantity theory, there are various forms of the quantity equation.

Classification

The quantity equation is based on the assumption that all transactions are processed by means of a determinable amount of money ( in the form of notes and coins or cash). The somehow defined money stock M would thereby in a certain period change several times through transactions from one hand to the next or from one account to the other, which is called velocity of circulation V. This money supply is not to be clearly defined and their velocity of circulation can not be measured. Therefore, the velocity of circulation in the quantity equation is calculated to match the selected quantity of money, so that M * V = P * T is true. The quantity equation is by definition always true and not empirically falsifiable.

With the quantity equation, the idea is connected to the controllable by the central bank money supply would directly determine the price level ( usually assumed to be at a constant rotational speed ), without effects on the real economy. Thus, the quantity equation is the basis of monetary targeting and stabilization policy of monetarism. Milton Friedman said inflation or deflation to a purely monetary problem, which the central bank could encounter by controlling the money supply.

History

The basic ideas of the later quantity theory have already been recognized by Jean Bodin. Building on Bodin led John Locke ( English philosopher ) the concept of velocity of circulation and the function of money as a medium of exchange. Thus Locke formulated the essential elements of the quantity theory for the first time. This idea was later shown by the Scottish economist David Hume simplified and eventually expanded by John Stuart Mill and announced. The quantity equation goes back to Simon Newcomb (1885 ) and in 1911 was clarified by the economist Irving Fisher. Particularly important for the Neoquantitätstheorie was the Nobel Prize winner Milton Friedman.

The most common versions of the quantity equation

Transactions and the quantity equation ( Transaction Version)

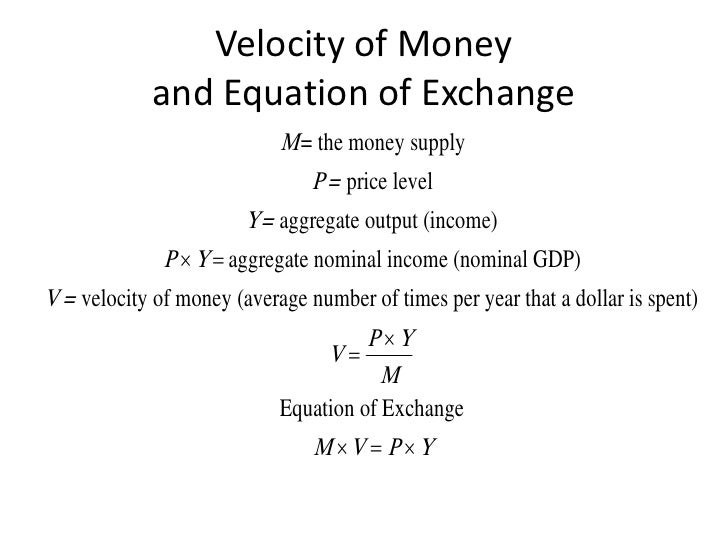

The quantity equation represents an identity equation; they are defined as follows:

While the right part of the equation (P * T) represents the volume of the transferred goods and services ( sales), the left side ( M * V) is the amount of money that is necessary for the exercise of transactions. As a result of tautology, both sides must match, ie the sum of all sales is equal to the sum of all payments.

From transactions to income (income Version)

However, the transaction form of the quantity equation raises problems. On the one hand, the number of transactions and the other is the corresponding average price level is not determined unambiguously. For this reason alternatives have been developed to the original quantity equation, such as the income of the quantity of form equation. In this modified form, the volume of transaction (T) by the total output (output Y ) is replaced. These two quantities are not completely identical, but they are very strongly connected to each other, since the amount of bought and sold goods and services increases with increase in production. As further empirical measures of the value of Y in the economics exist, corresponding to Y as the real GDP and the total income.

While the right part of the equation (P * Y) represents the value of goods produced ( nominal GDP ), the left side (M * V ) reflects the cash payments which are required for the purchase of these goods / services.

Cambridge version of the quantity equation

Another version of the quantity equation is based on the Cambridge equation, which states that the money supply to the product of nominal income equal to (P * Y) and average cash holding period ( k).

The already known to us velocity of circulation (V ) now corresponds to the reciprocal value of the average cash holding period used here (k):

While V represents the turnover rate of a unit of money within a period k specifies the duration of which is held one monetary unit of a business entity. If in the Cambridge equation, the cash holding period by the orbital velocity is obtained by changing the quantity equation. One can therefore say that the Cambridge and quantity equation are basically identical. The only difference lies in the use of cash holdings duration and velocity of circulation.

From the equation for the theory

The quantity equation is not yet a theory, but it is easily convertible. For this, two assumptions are needed. To a T (transactions ) or Y ( income ) to constant, since it is assumed that people maintain a constant share of their income. On the other hand, V is (rotation rate ) is set constant, since this variable by a plurality of fixed payment habits dependent (eg wages, salaries, taxes). This change only slowly and hence not subject to short-term changes.

The quantity theory of money states that a change in the money supply (M) has a proportional change in the price result. It can be concluded that a doubling of the money supply draws a doubling of the price by itself. Furthermore, the money supply affect nominal income (P * Y).

Effect of a change in money supply

When the money amount is increasing at a constant rotational speed, it has two possible reactions. Firstly, the quantity of goods produced can be increased ( real GDP) not yet operating at full capacity due to increased demand. On the other hand causes a money supply increase in capacity utilization a price increase, as the high demand encounters a constant supply of goods. A monetary inflation occurs.

Decreases the money supply at a constant rotational speed, this has a drop in demand result in what the company sales declines and stock educational means and may eventually lead to price reductions.