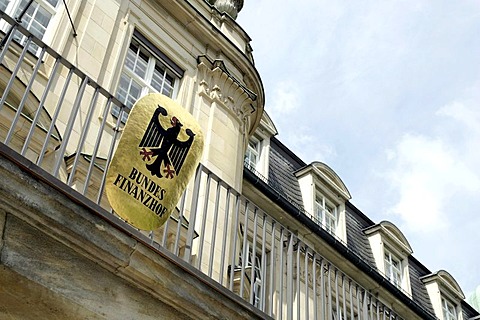

Federal Finance Court of Germany

The Federal Fiscal Court (BFH ), headquartered in Munich, is the highest court for tax, customs and, as such, in addition to the Federal Court, the Federal Administrative Court, the Federal Labour Court and the Federal Social Court one of the five supreme courts of the Federal Republic of Germany.

When authority is the Federal Fiscal - as the Federal Court and the Federal Administrative Court - departmental standard under the Federal Ministry of Justice and subject to its general supervision. In his capacity as court, however, it is independent. By 1970 the Federal Fiscal was subordinate to the Federal Ministry of Finance, which is partly an allegation of "House jurisdiction " provoked.

Tasks

The Federal Fiscal is the highest authority of the financial jurisdiction. He is one of the most established under Article 95 of the Basic Law of the Federal Supreme Courts. Its jurisdiction extends to the tax and customs matters; However, these do not include criminal tax proceedings, which are assigned as the ordinary criminal jurisdiction. The Federal Fiscal should also not be confused with the Federal Court. This controls the output behavior of the state and its institutions, while the Federal Fiscal may be appealed by the individual taxpayers in the last instance to test its tax return or the tax assessment made thereon by the tax office.

Except in tax matters in the true sense, the last instance decisions about home ownership, investment and professional legal affairs of Accountants are assigned to the Federal Fiscal. Since the migration from the Family Compensation for children power balancing the Federal Fiscal is also responsible for child support matters. For the children, money fulfills a dual function since then: It is used on the one hand the exemption of children subsistence level of income tax and the other as a benefit of promoting family. The Federal Fiscal come so far in addition to the last-instance decision in tax matters is of great importance in social law, to.

The Federal Fiscal operates primarily as an appellate court. In this role, he decides on revisions against the judgments of the Tax Court. In addition, he decides as a court of appeal over the place -like against certain decisions of the Tax Court appeal of the complaint.

As the Court of Appeals to the Federal Fiscal comes to a special responsibility for the development of the law and maintaining the uniformity of decisions. In addition, the Federal Fiscal is turned on in the proceedings of the Federal Constitutional Court. In tax proceedings that are brought before the Federal Constitutional Court, the Federal Fiscal are to the Federal Constitutional Court issued an opinion which will be considered in the decision of the Federal Constitutional Court.

The peculiarity of the legal process in the financial jurisdiction is that there are only two instances here. After dismissal of the action before the Tax Court may therefore be called directly with the revision of the BFH. However, a prerequisite is that the Tax Court has allowed an appeal to the Federal Fiscal in its judgment. If this is not the case, an appeal to the Federal Fiscal, known as leave to appeal, are charged with the application, to admit the appeal. Does the Federal Fiscal to the complaint to the revision, the process continues directly as a revision procedure.

Besides the complaint of refusal of the appeal knows the Finanzgerichtsordnung the complaint in other cases, in particular against decisions of the Financial Court, unless the appeal is expressly denied by law.

Recently, the appeal of Anhörungsrüge was created with only the violation of due process may be invoked ( § 133a Finanzgerichtsordnung ). In addition, is still the so-called remonstrance recognized, which can be raised informally. Since the Federal Constitutional Court, however, places strict requirements on the so-called appeal clarity in the appeal, the admissibility of the remonstrance in specialist literature is in doubt. Recently, the BFH ruled that the remonstrance is only permitted against modifiable decisions, ie decisions that do not grow in substantive law of force, and only when serious violations be reported. Previously, the so-called extraordinary appeal was still recognized. With regard to the newly created Anhörungsrüge the BFH no longer recognizes the extraordinary appeal.

History

The Federal Fiscal was built in 1950 in the tradition of Reichsfinanzhofs. This tradition, however, is only formal, not substantive in nature. Several presidents of the Federal Finance have repeatedly distanced himself from decisions of the Reichsfinanzhofs. A plaque inside the building is reminiscent of judgments of the Reichsfinanzhofs, the political requirements of the National Socialist leaders have uncritically reproduced. Here the assessments of the so-called Reich Flight Tax deserve particular mention, which was even charged by politically displaced.

Since December 2004, the BFH liaison with the Federal Administrative Court in the project Electronic some judicial and administrative mailbox. Pleadings and other documents can be sent quickly and safely to all participating courts and authorities legally in electronic form. Participation in negotiations of the Federal by videoconference is zzt. not possible.

Court Organization and Formation of the Court

The approach carried to the Federal Fiscal cases are decided by senates. The cases are divided according to subject matter and partly by letter criteria to the individual Senate. Currently, eleven Senate are established.

Judge of the Federal

The judges and judges of the Federal judges are elected by the Election Committee of the German Bundestag for life, appointed by the Federal President.

Allocation

Jokingly is sometimes the XII. Led Senate. These are the academic staff, the preparatory work for the federal judges in the respective senates.

Of particular significance are the III. and VI. Senate, as their judgments affect virtually every taxpayer and the width effect is therefore enormous. With the tariff law, the III. Senate is assigned, for example, the rising curve progression and the spouse - splitting, and the child benefit is affected virtually every taxpayer and every family. In addition, the investment for which also the III. Senate is responsible for the economic development of the entire membership area of paramount importance. The VI. Senate decides on all payroll tax disputes, for example, the advertising expense deduction. This applies to all workers. The rest of the Senate of the Federal touch individuals often only indirectly, as they only decide disputes of companies or on certain types of income substantially.

Exist between the Senates different views on legal issues, the Great Senate is called. The Senate shall consist of the President of the Federal and one judge of the Senate, in which the President is not in the chair. Its decisions give basic course for the future legal developments and are often the basis for the future legislative action dar.

President and Vice President

Building

The Federal Fiscal is, as before the Reichsfinanzhof, housed in a historic interest, Grade II listed building set in beautiful park in Munich's Bogenhausen. The predecessor of Bogenhausener contract in 1805 was closed.

The so-called butcher castle was built by an artist as an art gallery and exhibition building. After the client had fallen into bankruptcy, the building was remodeled and used to accommodate the Reichsfinanzhofs. Inside buildings, important works of contemporary and modern art are exhibited. The well-kept park is not open to the public, but can be done by appointment.