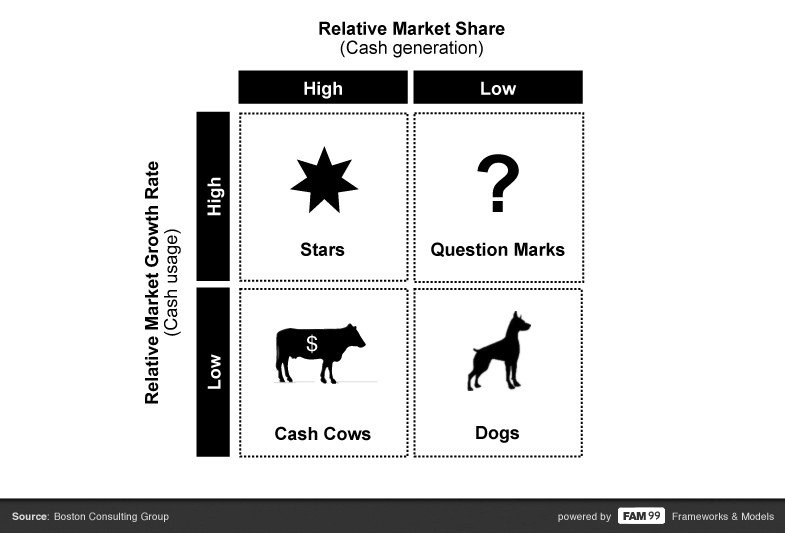

Growth–share matrix

The BCG matrix (also Boston - I- portfolio ) is a portfolio for the strategic management of companies. It was developed by the Boston Consulting Group ( BCG) and to clarify the relationship between the product life cycle and the cost experience curve. They can be built up in a matrix and is often represented graphically as scatter or bubble chart.

Portfolio construction

The idea of the product life cycle goes through the picture of the real future market growth on the ordinate. This is intended to represent the environmental dimension.

On the other hand, the abscissa based on the experience curve concept relative market share is eroded. It embodies the business dimension and is designed to reflect the idea that a company which has compared to the competition to higher sales volumes, gains experience. This additional experience leads mainly to cost - of scale and to reduce market risk.

The relative market share results from the ratio of its market share to that of the strongest competitors:

Or

For a breakdown of the portfolio dividing lines must be found. For market growth there is the parting line of the future average growth of the industry or the gross domestic product. Usually a value of 1.0 is assumed for the relative market share, however, a different value is also possible.

The diameters of the circles represent the sales of each product dar.

Standard strategies

The products or business units of a company will now be assigned to one of four areas based on their values . Each range embodies a so-called standard strategy. It should give a good recommendation on how to proceed. The life of a typical product runs from the question mark above star and cash cow for the Poor Dog. There are also products which do not follow this ideal way. Many flops reach not even the star field. An imitative product, however, possibly skips the field of Question Marks.

- The Question Marks (also question marks, products or young babies) are the newcomers among the products. The market has a high growth potential, but the products have little relative market shares. The management has to decide whether to invest or abandon the product. In the case of an investment, the product needs a lot of cash, but it can not generate itself. An offensive strategy is recommended. The strategy recommendation is: selection and possibly a penetration strategy to increase market share.

- The stars are the most promising products of the company. They have a high relative market share in a growth market. The amount of investment that results from the high market growth, cover, however, already high cash flow. The recommended strategy is: investment, as well as possibly a levy strategy to increase profit margins without jeopardizing the market share.

- The cash cows ( milking cows ) have a high relative market share in a modest growth or static market. They produce stable, high cash flows and may without further investments are " milked ". A fixed price strategy or price competition strategy is appropriate.

- The Poor Dogs are the Discontinued products in the company. You have a low market growth, sometimes even a market shrinkage and a low relative market share. No later than the contribution margin for these products is negative, the portfolio should be adjusted (disinvestment strategy).

But it is not only important to assess the individual products on the basis of standard strategies, but also to take the entire portfolio in inspection. Especially in this case, make sure that the static revenue sharing. The products in the portfolio should be able to support and finance each other. A Questionmark can expand only if, for example, the cash cow this extension subsidized. Also, future developments are indicated. Thus, the products should be represented equally in each area. A business without offspring Products has little chance in the future market.

Example

The above example portfolio is highly unbalanced. Although many products are in the liquidity -bearing areas of junior products are missing. The company will get medium to long term problems with his position on the market. This realization arises very simply with a look at the visualization of product sales by the so-called Bubbles. This is a major advantage of the model - the static overview sizes (in this case, absolute turnover ) in the dynamic dimensions ( the dimensions of the matrix).

From the perspective of product policy in marketing, it is advisable in this example, either to eliminate the existing services in the area Poor Dogs quickly or as strongly to bring onto the market that they can be prepared with suitable market communication for the coming market.

Such a situation also has a strong impact on the corporate credit rating under Basel II, the company currently raises Although high contribution margins from, but it is not said that the most good capitalization of the company is also investing time in product innovation. Since a loan request, the business valuation by the bank under Basel II interrogates only the static performance metrics without the consideration of a dynamic Ausschichtung of the product portfolio, the company will in the present example, both the EBIT analysis ( EBIT: earnings before interest and tax) as well as the value Metrics can represent excellent.

The problem with debt financing, however, the value of commitment to the future and thus the collateralization of the loan with expected future successes. Banks that have adapted to a Basel II-compliant performance appraisal will not recognize the strategic risk of their customers in this case. The company will possibly get large loans on favorable terms without the medium to long term income a result is to be expected in the current portfolio. Should a company take advantage of this immediately to finance new products, the further success of the party, however, can be relatively easily leveraged. The advantage of the BCG matrix here is thus in each case in the figure of current and perspective potential within the company.

Criticism

The relationship between market share and profitability is questionable since the development of the market share may require large investments. The PIMS study, however, has confirmed a relationship. In addition, the approach is a questionable high weight on market growth and ignores the potential of declining markets. The matrix could therefore downward, ie for shrinking markets, to be supplemented by two fields: underdog ( Under Dogs, sinking growth with low market share) and losers ( Buckets, sinking growth with high market share).

Another point of criticism refers to the growth rate of the market, which is considered in the model of BCG as a given. Indeed, a company may, however, be influenced by appropriate marketing measures market growth positively.

As usual dividing line between relatively low and relatively high market share is considered a value of 1.0. This means that only the market leader Stars and cash cows may have in its portfolio. The reduction of the values of the dividing lines (eg 1.0 for the relative market share and 5 percent for the real market growth) is purely subjective. You must be in the awareness that other values may lead to a different quadrant of the portfolio ( eg, 0.7 for the relative market share, or 8 percent of the real market growth) to a shift in the business. This would eventually lead to other standard strategies.

The matrix is only a snapshot and does not provide a forecast, but forms a basis for further considerations.