Icelandic króna

1 EUR = 156.262 ISK 100 ISK = 0.63995 EUR

1 CHF = 127.717 ISK 100 ISK = 0.78298 CHF

The Iceland Krona (Icelandic Króna íslensk, majority íslenskar krónur, Abbreviation: ISK) is the currency of Iceland. Just as the currency of other northern European countries, the term is derived from the Crown. In 1918 Iceland's independence from Denmark was declared and introduced the Icelandic krona. The Central Bank has since the year 1961 on the sole right to issue banknotes.

The name Iceland is first found on a coin from the year 1771, a Danish piastres. On the coin are the names of Iceland, Greenland and Faroe Islands. Iceland was then de facto a Danish colony. The Danish currency was legal tender.

The history of the independent Icelandic currency began in 1778, when Denmark is allowed Iceland to provide the official Danish currency with Icelandic characters. However, this currency could not prevail, also because it was not accepted in foreign trade. Founded in 1872 in Sweden, Norway and Denmark, the Scandinavian Monetary Union, which it introduced Danish Krone was now Icelandic cash.

National currency

With the independence of Iceland in 1918 and soon following the dissolution of the Scandinavian Monetary Union was introduced in the Icelandic krona.

Since 1961, the Central Bank of Iceland has the sole right to issue banknotes in Iceland. The right to issue coins it has since 1967. According to a currency reform on 1 January 1981, the crown was enhanced by a factor of 100, which means that 100 "old crowns " of a " new crown " corresponded.

In the course of technological change is increasingly established the use of electronic banking, payments by debit or credit card. Despite this development has increased since 2007, the cash flow in Iceland.

Development of the Central Bank

After the sovereignty of Iceland in 1918, the right to issue banknotes only the state-owned bank was awarded. In April 1961, the Central Bank of Iceland was created by an Act of Parliament. In 1986, the possibility of the central bank to influence the interest rate on banks and savings banks, abolished. This abolition led to more competition in the financial markets and a rising interest rate. In May 2001, entered a new commitment of the Central Bank in force, stating that it was the primary objective of monetary policy to maintain price stability. This top priority of maintaining price stability was also confirmed in the principles of the Icelandic Central Bank on 26 February 2009. The Bank is committed to the government to pass an annual report on its activities, which further contributes to the transparency of monetary policy. The Central Bank of Iceland is an independent institution that belongs to the state, but is under its own administration.

Rating

The credit is determined by the rating agencies. Among the best known rating agencies are Moody 's, Standard & Poor 's (S & P ) and Fitch Ratings. The agencies determine the creditworthiness and the probability of default of a country or an organization and thus obtain a ranking. Iceland was first tested in 1986 by S & P, and it was certified a good rating. The other agencies followed, and Iceland received a very good evaluation. In spring 2008, then the downgrade started by the agencies, and Iceland lost the certified credit worthiness.

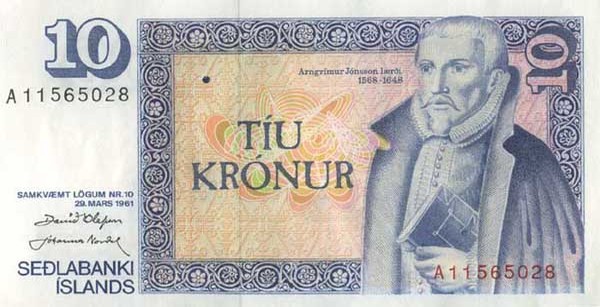

Banknotes and coins

Bills

In Iceland are five different banknotes of 500, 1000, 2000 and 5000 and since October 24, 2013 10000 crowns in circulation. Each banknote bears a facsimile signature of the Governors of the Central Bank. All bills have a watermark of the first statesman of Iceland Jón Sigurðsson ( 1811-1879 ).

This coin was put into circulation in 1981. It has a diameter of 21.5 mm. The weight is 4.5 grams. The coin is made of 75 % copper and 25 % nickel. Its edge is serrated. The front shows a giant, one of the four guardian spirits of Iceland. On the back of a cod is shown. 1989 or a one- crown coin was put into circulation. It is made of nickel plated steel and is equipped with 4.0 grams a little easier.

This coin was put into circulation in 1981. It has a diameter of 24.5 mm and its weight is 6.5 grams. The coin is made of 75 % copper and 25 % nickel. Its edge is also ribbed. The obverse shows the four guardian spirits ( dragon, eagle, bull, giant ) Islands. On the back of dolphins can be seen.

This coin was put into circulation in 1984. It has a diameter of 27.5 mm and a thickness of 1.78 mm. The weight is 8.0 grams. This coin is 75 % copper and 25% nickel. The edge of the coin is corrugated. On the front are the four guardian spirits of Iceland. The back is decorated by four Kabbelane.

This coin was put into circulation in 1984. It has a diameter of 23 mm and a thickness of 2.6 mm. The weight is 8.25 grams. It consists of an alloy of 70% copper, 24.5% zinc and 5.5 % nickel. The edge of the coin is smooth. On the front of the four guardian spirits of Iceland are also represented here. On the back there is a beach crab.

This coin was put into circulation in 1995. The 100 - krone coin has a diameter of 25.5 mm and a thickness of 2.25 mm. The weight is 8.5 grams. They consist of an alloy of 70% copper, 24.5% zinc and 5.5 % nickel. The edge of the coin is smooth. On its front side, the four guardian spirits of Iceland are shown. The back is adorned with a sea hare.

Safety Features

The safety features on cash find use for centuries. The first safety feature was a hand-written signature. Many other features have been added over time, for example, a special paper is used and incorporated a watermark the respective portrait. In addition, the bills fluorescent serial numbers, a security thread, metal foil and blind recognition features are still by a micro- text, backed up.

Economic crisis and its impact

In the economic crises from 1987 until 1995 the Northern European countries of Denmark, Norway, Finland and Sweden have been hit hard. Since these crises the countries concerned then belong to the EU, except Norway. This has the consequence that the control of such crises requires the EU's actions and not just the affected country itself forces them to act. Iceland was spared from these crises in the years 1987-1995, as Denmark was the least affected by this crisis. The economic crisis in Iceland took at the beginning of the new millennium its course, as the major banks of Iceland went through a privatization process. The three largest banks in Iceland ( Glitnir, Kaupthing and Landsbanki ) had substantial business abroad. This means that Iceland's development was funded by foreign loans. The problem for Iceland banks emerged on 15 September 2008, when the U.S. bank Lehman Brothers went bankrupt. These insolvency led to a loss of confidence between banks, so that it became more difficult to obtain loans. The financial institution Fortis and Dexia, the bank had to be rescued, and Iceland's banks also came under pressure. Investors withdrew their assets, and Glitnir was the first victim. Landsbanki fell on October 6 under pressure as investors withdrew their money within a few hours and the Bank no longer had sufficient liquid assets. On 7 October 2008, the Icelandic government was forced to act and nationalized the two banks. On 9 October, Kaupthing was put under state control and explained a few days later insolvent. This action by the Icelandic government was needed to prevent a national bankruptcy. The exchange rate of the Icelandic krona broke these days, a dramatic and recovers only slowly.

Restrictions in payments

For payment orders in ISK Iceland by the receiver requires a permit from the Icelandic Central Bank; the award as part of the permit number must be specified in the payment order. In addition, no Icelandic banknotes can be purchased at banks abroad. A withdrawal of ISK with a European debit card in Iceland from a non- Icelandic bank account is, however, possible. Also a transfer of euro on an Icelandic bank account can be performed.