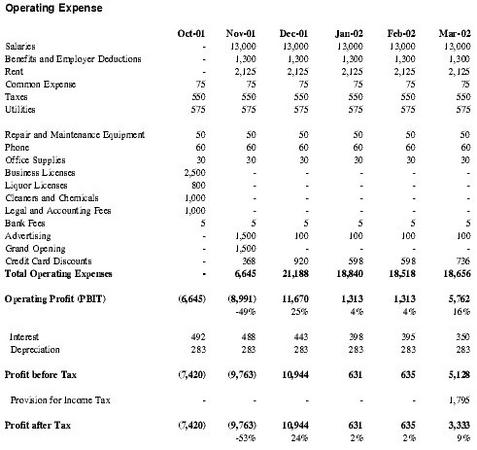

Operating expense

Operating costs ( Opex English for "operational expenditure" ) is a term used in business administration.

With operating costs of depletion, which is associated with the maintenance of the Company's operating activities of a company referred to. Colloquially disbursements, expenses or costs are often confused with the cost. From a business and economic sciences refer to these terms different cash flows of the business accounting and are both bookkeeping and cost accounting and tax delineated. Operating costs include, for example, the purchase of raw materials and supplies for the purpose of production and possibly personnel expenses and personnel costs. In addition there are also depreciation to the operating costs. In contrast to the cost of the investment for long- term capital assets are (English called Capex for " Capital expenditure" ). Operational costs beat initially reflected in the profit and loss account of a company. Investments represent an exchange of positions is on the asset side of the balance sheet ( " asset swap " ), for example in the form of access to the capital account at the same time leaving the cash in the same betraglicher height. Investments provide no initial depletion dar. Therefore, the term " investment costs " sometimes used by economic laypeople misleading. Only the use of funds in the context of investment assets leads to a decrease in value, which is reflected in the operating costs in the form of depreciation.

The abbreviation Opex is also of the terms

- Operating expense,

- Operating expenditure or

- Operational expense

Derived.

The higher the fixed costs of a company the lower the importance of operating costs and variable costs.