Securities lending

A securities (shares and stock borrowing or stock lending rarely ) is a transaction in which the lender a borrower leaves a security for a limited time to use what he usually receives a fee.

In a broader sense we group under the term securities lending or the equivalent English term "Securities Lending" in addition, the related business types and repurchase agreement (repurchase agreement, repo ) and sell- buy-back.

Term

In a securities lending is in the legal sense, contrary to the name is not a loan, but a loan in securities. Unlike a conventional lending transactions, the borrower becomes the owner of the securities and does not have the originally borrowed papers, but only those of the same kind and quality return. However, the term securities lending has naturalized, and economically the shops normally correspond lending.

Usually, it is agreed that the borrower, the lender lost income ( ie income incurred during the lending arrangement and therefore entitled to the borrower because of the transfer of ownership, ie interest payments, dividends) refunded. This corresponds to the obligation of a borrower in the legal sense, the borrowed items " with fruit " giving back in return. The fact that not the same securities are returned is economically meaningless, because securities of the same class of securities are fungible items. A return of the same papers would often be very costly or even impossible (eg in collective safe custody papers or book-entry securities ).

Market for securities lending transactions

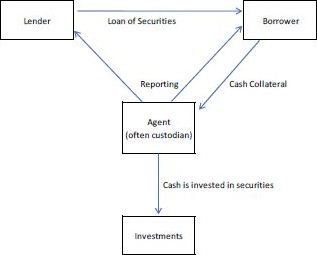

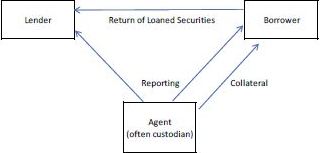

Lenders are usually large securities dealers, banks, funds and major shareholders. Usually the lender requires collateral in the form of cash or other securities ( collateralised borrowing, English collateralised lending).

A distinction Principal and Agent business. When principal transaction is handled by a market participant, such as a large custodian bank, the settlement of the Leihegeschäftes and occurs even as a contract partner. The same market participant may but also act as agents only. In this case, it is merely an intermediary between lenders and borrowers and takes over the processing of the transaction.

The lender generates more than the lending fees additional income, the business is very low risk especially in the case of a secured loan. The borrower may use the loaned securities for various purposes.

Securities lending to optimize the return on

Institutional investors and investment companies with large portfolios can surcharge improve their return on investment and reduce their costs through the rental depot of its securities to banks.

Securities for short selling and delivery problems

Securities lending are used to comply with the resulting short-selling delivery obligations. Upon a resale just acquired securities lending transactions may be used to bridge differences in the currency or delivery problems of the original seller.

Securities to refinance

Loaned securities can also be used to refinance. Thus, the lending is particularly in the bond market is a widespread practice, thanks to the market participants can obtain liquidity by selling borrowed title. Instead of the borrowed titles in the market to sell, they can also be used for liquidity shots with central banks in the context of open market operations or in the repo market.

Receives the lender for the borrowed securities consist of cash, this is for him a liquidity procurement dar. Economically a secured loan and a repurchase agreement are indistinguishable.

Securities lending as a tool for tax planning

Because different tax advantages may result through the lending of securities that result by then different treatment of income and capital gains from investments, this is also of banks and insurance companies like used instrument for the recovery of tax flexibility.

Securities lending for capital increases

Especially if they are issued is often resorted to the instrument of securities lending. Since New shares must first be entered in the relevant register court and up to this entry ultimately a residual uncertainty that this does not occur or is delayed, often initially in accordance with borrowed shares will be issued as a " new shares " even though they are old shares in the strict sense and the actual new shares once they have been approved, the lending party will be allocated as repayment.

Since each application for approval Young shares necessitates a corresponding publication, but it is often not desirable for tactical reasons, to inform the public even days in advance of the exact date of the capital increase, the detour via the securities lending an often chosen variant, the capital increase is only immediately before whose appointment is definitely to announce.

The new FRUG the disclosure requirements in this regard have been loosened a little, so that capital can now be made for capital increases to 10 %, only after registration.

Situation in Germany

In Germany there is the securities lending since 1990. Fund companies subject in Germany regarding ceremonies from their fund legal restrictions.