Stock market crash

As a stock market crash (or the stock market crash ) is called an extreme slump in the stock market. It takes a few days to a few weeks. During this time, dominate - usually panic - sales, which generate a large supply overhang and thus lead to drastically falling prices.

Stock market crashes occur most commonly at the end of a speculative bubble. But even in case of unexpected negative events - such as the Lehman Brothers bankruptcy - in extreme cases - such as the flash crash - also completely without news.

This can lead to a positive feedback: sell some market participants, so that the rates begin to fall. This drives more participants also into sales and prices continue to fall.

There is no clear definition of a stock market crash. In contrast to the bear market prices fall faster and sudden, a look of panic selling.

History

Stock market crises to the Great Depression

- On February 7, 1637 it came to the first surviving collapse of a stock exchange: After many Dutch investors on the occasion of the great tulip mania in anticipation of further price increases at extremely high prices tulip bulbs (or corresponding warrants ) had bought, ended up staying at the annual auction in Alkmaar, the buyer and prices fell by 95 percent.

- In 1700, the Darien company was not able to redeem their shares after the failure of their colonizing project in Panama.

- Stock market crash in 1847, the banking crisis in France and England in advance of the revolutionary upheavals of 1848.

- On 9 May 1873, the share prices plunged on the Vienna Stock Exchange into a bottomless pit ( founder noise ). Also in Germany and the United States fell from stock prices.

- The Black Friday of 24 September 1869 which was triggered by gold speculation entrepreneur Jay Gould and James Fisk and Countermeasures of the Government of the United States

- On May 5, it was due to the economic crisis of 1893 in the United States to substantial losses on the New York Stock Exchange, which particularly hit railroad stocks.

- On March 13, 1907, the prices on the New York Stock Exchange collapsed. The causes parched cash flows as a result of the Russo -Japanese War, the rebuilding of San Francisco after the great earthquake of 1906 and a Uber- expansion in some large railway companies are considered. Then there was a very late harvest which busied the farmers.

- The Black Friday 13 May In 1927 the share index of the Reich Statistical Office on the Berlin stock market slump by 31.9 percent.

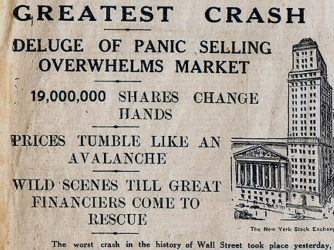

- The Black Thursday on October 24, 1929 is regarded as one of the causes of the Great Depression.

Stock market crises after the collapse of the Bretton Woods system

- On October 19, 1987, the Dow Jones dropped by more than 20 percent of the so-called Black Monday. However, the prices recovered within a year, after 15 months, the Dow Jones had again to stand before the crash.

- In January 1990, the Japanese Nikkei fell by almost half.

- On August 19, 1991, after the coup against Soviet President Mikhail Gorbachev, the DAX lost 9.4 percent in a day.

- The terrorist attacks on September 11 led to a four-day suspension of trading. The DAX lost 8.5 percent that day. Immediately after the reopening of the Dow Jones index fell by more than seven percent.

- In the context of the financial crisis starting in 2007, the Nikkei index fell on 16 October by 11.4 percent and witnessed the second biggest daily loss in the entire history of the index. Individual funds, such as a flagship of Goldman Sachs, reported even greater losses and laid by the declaration as a 25 -sigma event the questionable nature of the mathematical model used open.